The public is in a foul mood over increasing college costs and student debt burdens. Talk of a “higher education bubble” is common on the contrarian right, while the Occupy Wall Street crowd is calling for a strike in which in which ex-students refuse to pay off their loans.

This week, President Barack Obama held a summit with a dozen higher-education leaders “to discuss rising college costs and strategies to reduce these costs while improving quality.” The administration plans to introduce some policy proposals in the run-up to the presidential campaign.

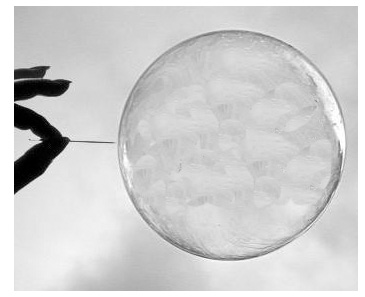

Any serious policy reform has to start by considering a heretical idea: Federal subsidies intended to make college more affordable may have encouraged rapidly rising tuitions.

It’s not as crazy as it might sound.

As veteran education-policy consultant Arthur M. Hauptman notes in a recent essay: “There is a strong correlation over time between student and parent loan availability and rapidly rising tuitions. Common sense suggests that growing availability of student loans at reasonable rates has made it easier for many institutions to raise their prices, just as the mortgage interest deduction contributes to higher housing prices.”

It’s a phenomenon familiar to economists. If you offer people a subsidy to pursue some activity requiring an input that’s in more-or-less fixed supply, the price of that input goes up. Much of the value of the subsidy will go not to the intended recipients but to whoever owns the input. The classic example is farm subsidies, which increase the price of farmland.

[...]

U.S. Universities Feast on Federal Student Aid: Postrel - Bloomberg

No comments:

Post a Comment