The business world and the public are beginning to realize that few investments are solid anymore, with the government being even less so.

A “run” is a mass withdrawal of cash funds from a borrower. We are in the midst of a continuing worldwide credit crisis, punctuated by “runs” of varying prominence and publicity.

These runs are rational, not panics and not due to quirks of psychology. They occur when investors realize that their funds are endangered in an institution. They try to get them out before they lose them.

Looks like I'm not the only one pulling whatever I can extract from the clutches of these organizations and putting them under my mattress.

The danger comes when the institution no longer is getting cash inflows in sufficient amounts to pay off all its obligations. In businesses, this comes about through sour investments. In governments, it comes about through wasteful spending that fails to be recovered in tax revenues.

In the year 2008, we saw runs on major Wall Street investment banks, money market mutual funds, domestic banks and foreign banks. Now we are seeing runs on governments in Europe such as Greece and Portugal. Sovereign debts are being sold down hard as investors flee from them, converting their bonds into currency.

Three years from the 2008 credit crisis, the Federal Reserve is still providing massive credit to U.S. banks. This props them up against bank runs. Every so often, the FED extends credit to foreign central banks to prop them up so that they can prop up their financial institutions. These are stopgaps. All of this propping up depends on faith in one currency: the U.S. dollar.

With the fact that the Federal Reserve is a private entity, not a federal agency or division, but is managed by a board that consists of executives from the major banking firms, it is easy to see how this can lead to a situation where only those running the show could end up benefiting from a failing financial system.

Runs on various institutions often show up as a flight into short-term U.S. treasuries, i.e, the dollar. This is because the treasury market is deep.

Since the dollar is also a credit instrument, it is subject to credit risk. What happens when trust in the dollar drops sharply? What happens to all these financial institutions being propped up by creating dollars when trust in the dollar fails? That is when the financial system cracks wide open. That is when governments will be tempted to freeze funds in banks and prevent withdrawals the way that Argentina did. That is when the FED will be tempted to guarantee almost any institution against cash withdrawals, but when such a guarantee will be ignored. That is when gold will soar in price against the dollar and all other fiat currencies.

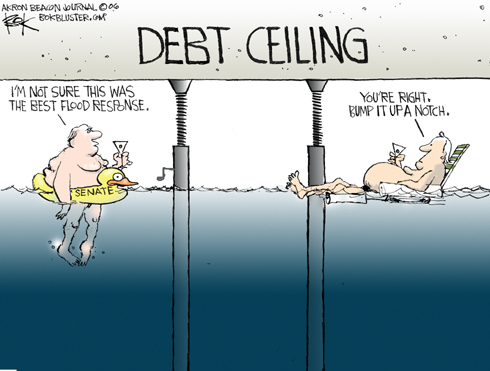

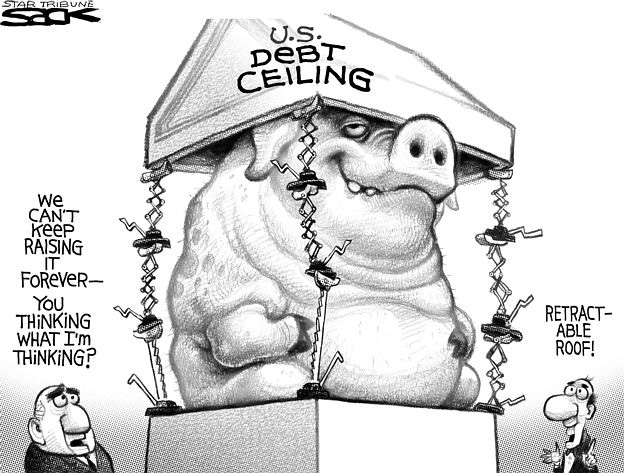

I am describing a run on the United States government. This will be a withdrawal of cash financing from the U.S. government. This is the ultimate credit crisis upheaval. This will be accompanied by mass social unrest and political reorganization. Stock and bond prices will fall sharply. The S & P 500 will lose at least 60 percent. Government bonds will yield at least 10 percent. This event is foreseeable. It is also avoidable, but not without much pain and travail. Hence, although foreseeable and avoidable, it may still occur.

Combine those realizations with the one that puts the Fed into focus. It is independent, but not regulated by our own government.

Whether we like it or not, we are all currency speculators now. This is hardly a burden we can relish.

Whether or not a run on the United States government occurs is in the hands of its creditors. It depends on their trust in the dollar. Their trust depends on their understanding of America’s political economy.

Anyone who looks objectively at actions being taken by the U.S. government to bolster its credit or cause its credit to deteriorate has to reach a very negative conclusion. Why? Simply because the country’s leadership has been taking it downhill for decades on end. America is like a bright and fresh red apple in which rotting has been proceeding inexorably. The apple still has some edible portions but large parts of it are gone. The seeds need to be planted and a new tree grown.

http://dumpdc.wordpress.com/2011/07/16/a-run-on-the-united-states-government/

End the Fed.

Share on Facebook

Share on Facebook Share on Twitter

Share on Twitter