"The average interest earning on a savings account in the bank is around 0.10 percent, therefore, a $100,000 savings account earns you $100.00 in a year. Many people are now wondering if they should just keep there money under the mattress." sounds like sound advice to me. Converting it to gold or silver, which increases as the dollar devalues, is probably an even more sound investment.

Almost every trader and investor will be waiting patiently for the Federal Open Market Committee(FOMC) interest rate decision, that announcement is expected to be released this afternoon. The Federal Reserve Bank Chairman, Ben Bernanke, will hold his second press conference after the Fed funds rate decision is announced. Therefore, the major stock indexes could remain range bound until all of these events take place.

Many traders and investors are expecting the Federal Reserve to leave the Fed funds rate unchanged at zero to a quarter percent. This rate is the overnight lending rate to the large financial institutions such as J.P. Morgan Chase & Co.(NYSE:JPM), Wells Fargo & Co.(NYSE:WFC), Bank of America Corp.(NYSE:BAC), and Citigroup Inc.(NYSE:C). These banks can basically borrow unlimited capital at zero percent. This important lending rate has been at this level since December 2008. This is the reason why bank customers hardly earn any interest on their savings account. In essence, savers get punished for not taking risk these days. The average interest earning on a savings account in the bank is around 0.10 percent, therefore, a $100,000 savings account earns you $100.00 in a year. Many people are now wondering if they should just keep there money under the mattress.

Many traders and investors are wondering if Chairman Ben Bernanke will hint that he will start another quantitative easing program soon. Currently, the Federal Reserve is scheduled to end its $600 billion quantitative easing program on June 30, 2011. This program has helped to create cash reserves on the banks balance sheets. These banks can then take this money and invest in stocks, commodities, and other market instruments helping to inflate the stock markets higher. Last summer, when the stock market faced its most severe correction and a possible double dip recession, Ben Bernanke announced his current QE-2 program and the stock markets skyrocketed higher. We can only wonder if QE-3 will be announced soon if the major stock indexes continue to slump.

Nicholas Santiago

Collapse, Environmental Science, Politics, Economics, with a Dash of Sky-is-Falling Paranoia. And Zombies.

22 June 2011

A Review of Peak Oil Dangers

How can (the myth of) infinite growth continue when our energy sources that drive growth are either leveling off or in decline? The cost of most goods and services are directly related to energy costs, so a decline in oil production translates to an increase in the costs of those goods and services. If oil production decreases dramatically, then many of those goods and services may become too inefficient to maintain availability. Here are excerpts from an article at peakoil.com that gives some insight into the situation:

More at: http://peakoil.com/production/peak-oil-the-clear-and-present-danger/

Global oil production (crude oil plus condensate) has been on a plateau / in decline for 7 years resulting in high energy prices that are feeding inflation, eroding family budgets and crippling the World economy. It is time for the international political community to awaken to the risks posed by Peak Oil. A British Government report published last week under a Freedom of Information Act (FOIA) request makes clear that civil servants working at the UK department of Energy and Climate Change (DECC) seem very aware of the risks posed by peak oil, and yet the British Government seems happy to continue to ignore warnings.

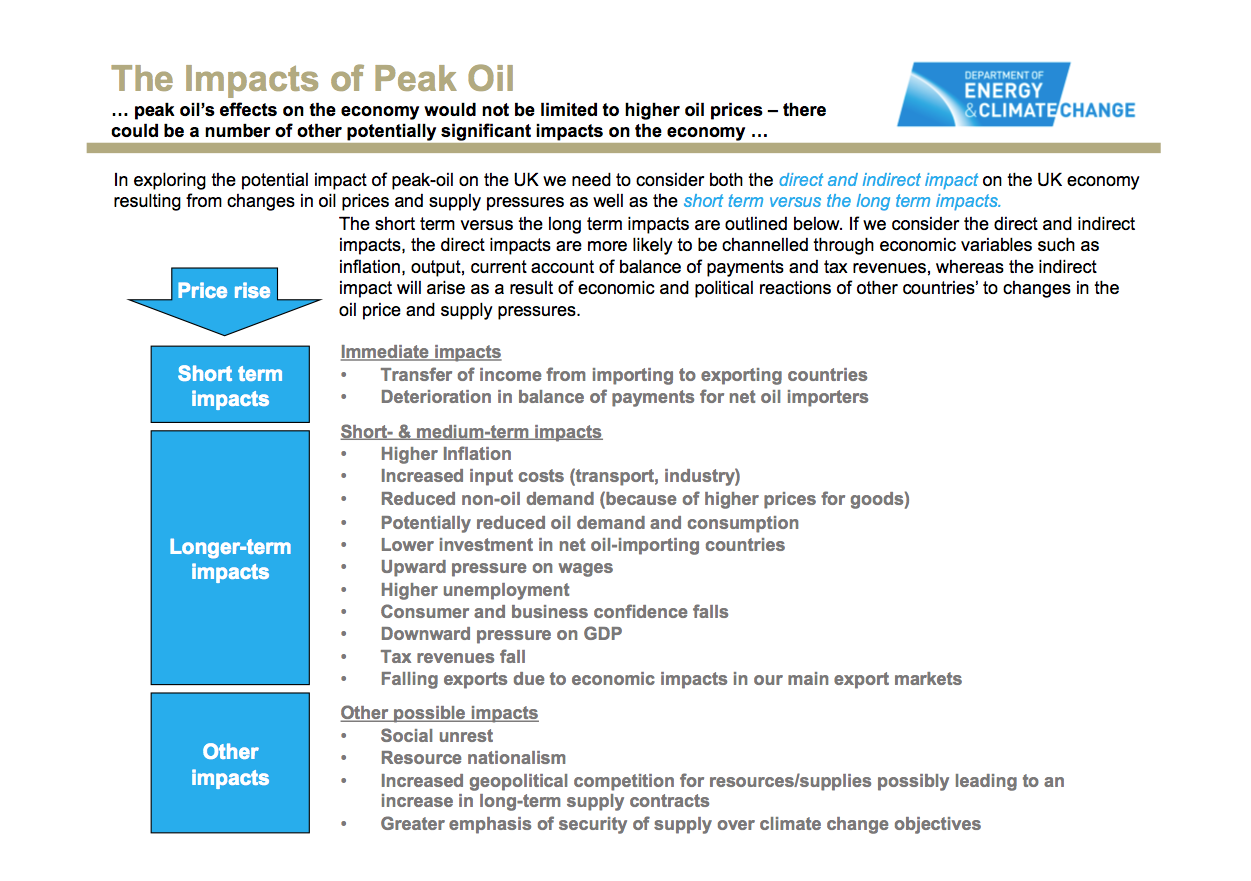

Last week The UK Guardian "newspaper" carried a story about an internal UK government report on peak oil that the government failed to make public and was eventually released under a Freedom of Information Act (FOIA) request made by French student Lionel Badal. The report, in form of a data and text rich Power Point presentation landed in my inbox (hat tip to Jerome) and I was quite amazed by the content. Slide 16 in particular caught my attention:

Dinosaurs never believe you when you tell them that their extinction is imminent.Of the 17 bullet points on the slide 16 have come to pass in the UK and in the neighbouring countries of Europe (click on slide to enlarge and open in separate window). Given that the research was conducted in 2007 and the report compiled in 2009 this conveys amazing insight by the DECC civil servants. Many may argue for different causes for the peak oil symptoms listed by DECC. But given the length of the list, near perfect correlation between forecast and events and the fact that global oil production has not increased for seven years, is it not safe to now draw the conclusion that peak oil lies at the heart of the UK and global economic woes?

Two important items are missing from the list and when these are taken on board the story is complete.

Methodology and observations

There are four main agencies reporting on global oil production:

1. The Energy Information Agency (EIA) in Washington that is a US Government agency.

2. The International Energy Agency (IEA) in Paris that is an OECD agency.

3. The BP statistical review of world energy, produced by BP, the UK based international oil company

4. The Joint Oil Data Initiative (JODI) that is a voluntary form of NGO.

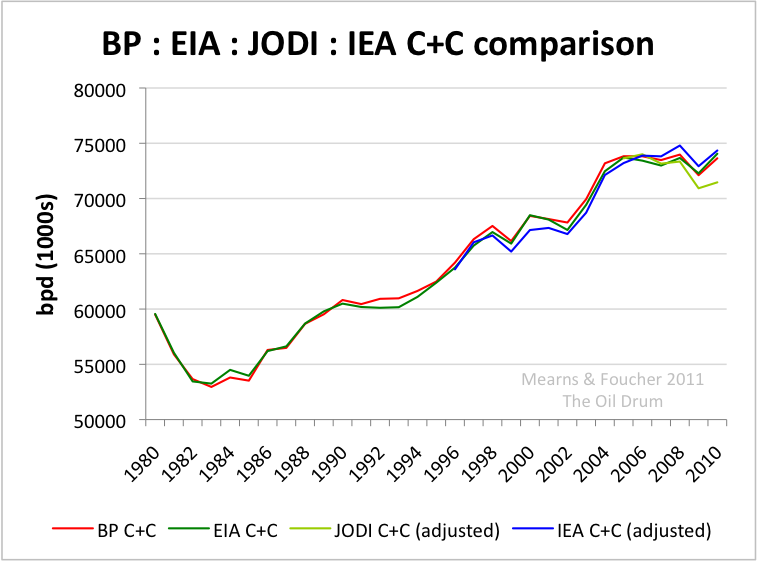

These agencies may gather information in different ways and they also report data in different ways using different categories and definitions of oil. The EIA reports monthly production data for crude oil + condensate (C+C) that includes synthetic crude oil produced from tar sands in Canada and Venezuela for all countries and giving a world total. JODI also reports C+C but only for 90 countries accounting for around 90% of global production. In the first post in this mini series, Dr Sam Foucher filled in the missing countries from the JODI data using EIA data giving an adjusted JODI proxy for global production that may then be compared with the EIA global total. BP report annualised average daily production data for C+C+NGL (natural gas liquids) and these data are not directly comparable to C+C reported by EIA and JODI. TOD commenter KLR deducted NGL data reported by the EIA from the BP data to get a BP proxy for C+C that is plotted in the chart up top.

Key Observations

The two previous posts in this series here and here examined the divergence between the EIA and JODI data since 2009 (see chart). Introducing BP and IEA data to the mix shows good agreement with the EIA and may tend to argue that these three sources provide the most reliable data. However, it may be the case that the EIA, BP and IEA are obtaining their data from the same source which remains unknown but rumored to be IHS. The source of JODI data is known to be direct reporting by national governments to JODI and it remains intriguing that the JODI data, which are based on government statistics, are diverging from the rest. The latest JODI production data reported for March 2011 shows production below 70 mmbpd. That is 6 mmbpd below the equivalent IEA data.

A production plateau was reached in 2004. The JODI data suggest that production may now be in decline whilst the EIA, BP and IEA data suggest that production remains on the range bound plateau. The difference here is really immaterial since high energy prices post 2007 caused by a failure to raise production to meet demand are traumatising the global economy.

The Oil Drum

More at: http://peakoil.com/production/peak-oil-the-clear-and-present-danger/

21 June 2011

Jenkies! Velma Against the Undead

It looks like Velma and Scooby are the only survivors of Mystery, Inc. Now they continue the fight against the living dead instead of unmasking that mean Old Man Withers. Besides, what good is a collapse without zombies?

This was not the original post scheduled for this afternoon, but when The Blot saw Threadless had released this Scooby-Doo themed t-shirt yesterday I knew I had to blog about it ASAP! “We’ve Got Some Work To Do Now” is pure awesome! It takes place in a post-apocalyptic world over run by zombies and features the sole survivors of Mystery, Inc., Velma and Scooby, as they prepare to battle the undead.More: The Blot Says...: Threadless - “We’ve Got Some Work To Do Now” Scooby-Doo Themed Zombie T-Shirt

17 June 2011

Prophets of Doom Documentary with Michael C. Ruppert

Michael Ruppert returns in a new documentary on the heels of Collapse. He and others help us understand the components of our modern world that are unsustainable and lead us on a path toward a massive collapse beyond anything we have seen in recent history.

Is it really that difficult to believe that infinite growth is a myth? Debt is spiraling upward and completely beyond the reach of potential solutions. Population growth is directly tied to cheap energy. With oil being responsible for most global growth, the withering supply will also have an effect on the population. Care to wager a guess as to it's impact?

Is it really that difficult to believe that infinite growth is a myth? Debt is spiraling upward and completely beyond the reach of potential solutions. Population growth is directly tied to cheap energy. With oil being responsible for most global growth, the withering supply will also have an effect on the population. Care to wager a guess as to it's impact?

15 June 2011

Michael Ruppert's Lifeboat Hour on the Progressive Radio Network

Michael Ruppert's weekly Lifeboat Hour radio show on the Progressive Radio Network.

http://www.progressiveradionetwork.com/the-lifeboat-hour/

http://www.progressiveradionetwork.com/the-lifeboat-hour/

The Coming Economic Hell For American Families

Tens of millions of American families are about to go through economic hell and most of them don't even realize it. Most Americans don't spend a whole lot of time thinking about things like "monetary policy" or "economic cycles". The vast majority of people just want to be able to get up in the morning, go to work and provide for their families. Most Americans realize that things seem "harder" these days, but most of them also have faith that things will eventually get better. Unfortunately, things aren't going to get any better. The number of good jobs continues to decline, the number of Americans losing their homes continues to go up, people are having a much more difficult time paying their bills and our federal government is drowning in debt. Sadly, this is only just the beginning.

Tens of millions of American families are about to go through economic hell and most of them don't even realize it. Most Americans don't spend a whole lot of time thinking about things like "monetary policy" or "economic cycles". The vast majority of people just want to be able to get up in the morning, go to work and provide for their families. Most Americans realize that things seem "harder" these days, but most of them also have faith that things will eventually get better. Unfortunately, things aren't going to get any better. The number of good jobs continues to decline, the number of Americans losing their homes continues to go up, people are having a much more difficult time paying their bills and our federal government is drowning in debt. Sadly, this is only just the beginning.Since the financial collapse of 2008, the Federal Reserve and the U.S. government have taken unprecedented steps to stimulate the economy. But even with all of those efforts, we are still living in an economic wasteland.

So what is going to happen when the next wave of the economic crisis hits?

During one recent interview, Peter Schiff made the following statement....

If you look at the economic relapse that's going on right now, look at Friday's abysmal job numbers, look at the housing numbers, understand that all of this is taking place with record monetary and fiscal stimulus. What happens if we remove those supports?At the end of June, the Federal Reserve's quantitative easing program is slated to end. The U.S. Congress and state legislatures from coast to coast are talking about budget cuts. The amount of borrowing and spending that has been going on is clearly unsustainable, but will the U.S. economy start shrinking again once the current "financial sugar high" has worn off?

Already, all sorts of bad economic news has been coming out and all kinds of economic indicators are turning south. The American people are becoming increasingly restless. One new poll has found that 59 percent of the American people disapprove of Barack Obama's handling of the economy (which is a new high). According to another recent poll, 63% of Americans say that they feel "not good" or "bad" about how the U.S. economy is performing.

If most Americans had good jobs, could afford their mortgages and could pay their bills, the economy would not be such a big issue.

Unfortunately, times are really tough for American families right now and they are about to get a lot tougher.

*Jobs*

The official unemployment rate just went up to 9.1 percent, but that figure only tells part of the picture.

There are some areas of the country where it seems nearly impossible to find a decent job. Millions of Americans have fallen into depression as they find themselves unable to provide for their families.

According to CBS News, 45.1 percent of all unemployed Americans have been out of work for at least six months. That is a higher percentage than at any point during the Great Depression.

Just two years ago, the number of "long-term unemployed" in the United States was only 2.6 million. Today, that number is up to 6.2 million.

Can you imagine being out of work for 6 months or more?

How would you survive?

Just look at the chart below. What we are going through now is really unprecedented. The average duration of unemployment in this country is now close to 40 weeks....

So will things get any better soon? Well, there were only about 3 million job openings in the United States during the month of April. Normally there should be about 4.5 million job openings. The economy is slowing down once again. Good jobs are going to become even more rare.

There are millions of other Americans that are "underemployed". All over the United States you will find hard working Americans that are flipping burgers or working in retail stores because that is all they can get right now.

Most temp jobs and most part-time jobs don't pay enough to be able to provide for a family. But there are not nearly enough full-time jobs for everyone.

Sadly, the number of "middle class jobs" is about 10 percent lower than a decade ago. There are simply less tickets to the "good life" than there used to be.

*Homes*

But without good jobs, the American people cannot afford to buy homes.

Without good jobs, the American people cannot even afford the homes that they are in now.

U.S. home prices have fallen 33 percent since the peak of the housing bubble. That is more than they fell during the Great Depression.

This decline in housing prices has caused a lot of problems.

28 percent of all homes with a mortgage in the United States are in negative equity at this point. There are millions of American families that are now paying on mortgages that are for far more than their homes are worth.

Millions of American families literally feel trapped in their homes. They can't afford to sell their homes, and if they simply walk away nobody will approve them for new home loans for many years to come.

Many Americans are sticking it out and are staying in their homes until they simply can't pay for them anymore.

As the number of good jobs continues to decline, the number of Americans that are losing their homes continues to rise.

For the first time ever, more than a million U.S. families lost their homes to foreclosure in a single year during 2010.

If the economy slows down once again and millions more Americans lose their jobs this problem is going to get a lot worse.

*Bills*

Even if they aren't losing their homes yet, millions of other Americans families are finding it increasingly difficult to pay the bills.

Wages have been very flat over the past few years and yet the cost of most of the basics just seems to keep going up and up.

According to Brent Meyer, a senior economic analyst at the Federal Reserve Bank of Cleveland, the cost of food and the cost of energy have risen at an annualized rate of 17 percent over the past six months.

Have your wages gone up by 17 percent over the past six months?

As 2009 began, the average price of a gallon of gasoline in the United States was $1.83. Today it is $3.77.

American families are finding that their paychecks are going a lot less farther than they used to, but Ben Bernanke keeps insisting that we have very little inflation in 2011.

Most Americans don't care much about economic statistics - they just want to be able to do basic things like take their children to the doctor.

According to one recent survey, 26 percent of Americans have put off doctor visits because of the economy.

Sadly, soon a lot more American families will not be able to afford to go to the doctor.

According to one recent survey, 30 percent of all U.S. employers will "definitely or probably" quit offering employer-sponsored health coverage once Obamacare is fully implemented in 2014.

As the economic situation has unraveled, an increasing number of people are being forced to turn to the federal government for assistance.

One out of every six Americans is now enrolled in at least one anti-poverty program run by the federal government.

Some of the hardest hit members of our society have been our children. Today, one out of every four American children is on food stamps.

Back in the old days, a large percentage of American families were self-sufficient, but that is no longer the case.

Back in 1850, approximately 50 percent of all Americans worked on farms.

Today, less than 2 percent of Americans do.

So these days when American families can't feed themselves what do they do?

They turn to the federal government of course.

At the moment, approximately 44 million Americans are on food stamps.

But our federal government cannot afford to spend money like this forever.

According to a recent USA Today analysis, the U.S. federal government took on $5.3 trillion in new financial obligations during 2010. USA Today says that the U.S. government now has $61.6 trillion in financial obligations that have not been paid for yet.

Wow!

Who is going to end up paying that bill?

So with so much bad news, are our leaders alarmed?

Not really.

According to Federal Reserve Chairman Ben Bernanke, "growth seems likely to pick up somewhat in the second half of the year."

Yeah, we'll see how that prediction works out.

Others are not so sure that everything is going to turn out okay.

Recently, James Carville warned that we could literally see rioting in the streets if the economic situation does not turn around soon. Just check out the last part of the video below....

The truth is that America is in decline. Just like with all of the great empires of the past, our empire is starting to crumble too.

A recent article in the Guardian touched on some of the reasons for America's decline....

The experience of both Rome and Britain suggests that it is hard to stop the rot once it has set in, so here are the a few of the warning signs of trouble ahead: military overstretch, a widening gulf between rich and poor, a hollowed-out economy, citizens using debt to live beyond their means, and once-effective policies no longer working. The high levels of violent crime, epidemic of obesity, addiction to pornography and excessive use of energy may be telling us something: the US is in an advanced state of cultural decadence.The economic news is only part of the puzzle. This country has rejected the ancient wisdom that was passed down to us and we have rejected the principles of our founding fathers.

We have piled up the biggest mountain of debt in the history of the world and yet somehow we expected that everything would turn out okay.

Well, everything is not going to turn out okay.

All of this debt is going to come down on us like a ton of bricks and the U.S. economy is going to continue to fall apart. Millions of American families are going to lose their jobs and their homes.

Economic hell is coming.

You better get ready.

Stock Prices Have Fallen For Six Weeks In A Row

Well, it's official. U.S. stock prices have fallen for six weeks in a row. So will next week make it seven? The last time stocks declined for seven weeks in a row was back in May 2001 when the "dot-com" bubble was bursting. At this point, the Dow has declined by approximately 5 percent since the beginning of June. Things don't look good. So exactly what is going on here? Well, it is undeniable that the recent mini-bubble in stocks has been too good to be true. The S&P 500 had surged nearly 30 percent since last September. Much of this has been fueled by the Federal Reserve's latest round of quantitative easing, but now that is coming to an end in a few weeks and investors are a bit spooked. Meanwhile, wars and revolutions are sweeping the Middle East, Japan is dealing with the damage caused by the tsunami and by Fukushima, Europe is trying to figure out how to bail out Greece again and the U.S. debt crisis is continually getting worse. In addition, wave after wave of bad economic news is certainly not helping the mood on Wall Street. In many ways, a "perfect storm" is developing and many are now extremely concerned about what the rest of 2011 is going to bring for Wall Street.

Well, it's official. U.S. stock prices have fallen for six weeks in a row. So will next week make it seven? The last time stocks declined for seven weeks in a row was back in May 2001 when the "dot-com" bubble was bursting. At this point, the Dow has declined by approximately 5 percent since the beginning of June. Things don't look good. So exactly what is going on here? Well, it is undeniable that the recent mini-bubble in stocks has been too good to be true. The S&P 500 had surged nearly 30 percent since last September. Much of this has been fueled by the Federal Reserve's latest round of quantitative easing, but now that is coming to an end in a few weeks and investors are a bit spooked. Meanwhile, wars and revolutions are sweeping the Middle East, Japan is dealing with the damage caused by the tsunami and by Fukushima, Europe is trying to figure out how to bail out Greece again and the U.S. debt crisis is continually getting worse. In addition, wave after wave of bad economic news is certainly not helping the mood on Wall Street. In many ways, a "perfect storm" is developing and many are now extremely concerned about what the rest of 2011 is going to bring for Wall Street.QE2 is slated to conclude at the end of June, and many investors are deeply disappointed that it does not appear that we are not going to see QE3 right away. Many fear that the end of quantitative easing will pop the current mini-bubble in stocks and commodities. At the moment, financial markets are more jittery than they have been in a long time.

Frank Davis, director of sales and trading with LEK Securities, says that there is a lot of pessimism on Wall Street right now....

"There's a lot of emotion in this market at the moment, and the conversations among traders are nearly all leaning toward the bear side"So what are some of the signs that this downturn on Wall Street may turn into a full-blown crash?

Well, according to the Wall Street Journal, junk bonds are being sold off at an alarming rate right now. Does the following quote from the Journal remind anyone of 2008 at least a little bit?....

A steep decline in prices of bonds backed by subprime mortgages has spread through the riskiest segments of the credit markets, ending rallies in high-yield corporate bonds and commercial real-estate debt.Also, many of the big Wall Street banks are already laying off workers. In a previous article I wrote about the potential for Wall Street to go into "panic mode", I noted that Goldman Sachs, Bank of America, JPMorgan Chase and Morgan Stanley are all laying people off or are considering staff cuts.

The truth is that the big banks on Wall Street are not nearly as stable as most people think that they are. Moody's recently warned that it may downgrade the debt ratings of Bank of America, Citigroup and Wells Fargo.

Another major story on Wall Street right now is oil. OPEC recently announced that oil production levels will not be raised, even though the price of oil has been hovering around $100 a barrel.

World oil supplies are very tight right now. In fact, the globe actually consumed 5 million barrels per day more oil than it produced during 2010. This was possible because the difference was apparently made up by drawing down reserves.

But if oil supplies are this tight already, what is going to happen if a major war (as opposed to all of the minor wars that are already happening) erupts in the Middle East?

The world is sitting on the edge of a financial disaster.

It is important to keep in mind that Europe is also in far worse financial condition than it was just prior to the financial collapse of 2008.

It is being reported that German finance minister Wolfgang Schaeuble is convinced that a "full-blown" financial meltdown by Greece is a very real possibility. The cost of insuring Greek debt has soared to a brand new record high, and officials all over Europe are in panic mode.

But financial problems are not just happening in Greece. The largest bank in France has just cut in half the amount of cash that customers can withdraw from ATMs each week.

Most Americans don't spend much time thinking about the financial condition of Europe, but the truth is that what happens in Europe is going to play a major role in the months and years ahead.

Of course most Americans already know that the U.S. government is a financial mess.

As the "debt ceiling deadline" of August 2nd draws closer, the U.S. government has been raiding retirement funds in order to stay under the debt limit.

Many investors are quite nervous about what may happen if the U.S. government actually does start defaulting on debt on August 2nd.

Others claim that the U.S. government is already in default.

The only Chinese agency that gives credit ratings on sovereign debt says that the U.S. government "has already been defaulting" and the Chinese government has been repeatedly warning that the U.S. needs to get its finances in order.

In any event, this debt ceiling drama will get resolved one way or another.

The bigger question is this....

How is the U.S. government going to respond when the next financial crash happens?

Back in 2008, the Federal Reserve and the U.S. government took unprecedented steps to prop up Wall Street.

But can they really do that again if we see another major crash in 2011 or 2012?

Many believe that things will be totally different this time around. Just check out what Jim Rogers recently told CNBC....

"The debts that are in this country are skyrocketing," he said. "In the last three years the government has spent staggering amounts of money and the Federal Reserve is taking on staggering amounts of debt.Jim Rogers is right about that.

"When the problems arise next time…what are they going to do? They can't quadruple the debt again. They cannot print that much more money. It's gonna be worse the next time around."

The next time we see a collapse on the scale of 2008 it is going to be a much bigger mess.

Global financial markets are extremely vulnerable right now and there are a whole host of potential "tipping points" which could push them over the edge.

The Federal Reserve and the U.S. government more or less used up all of their ammunition on the 2008 crisis.

If we see another collapse in 2011 or 2012 there is not going to be much of a safety net available.

The entire world financial system is simply swamped with way too much debt. The world has never seen anything even remotely close to the gigantic mountains of debt that have been accumulated around the world today.

The current global financial system is not sustainable. More crashes are inevitable. A lot of people are going to get steamrolled.

Hopefully you will not be one of them.

Subscribe to:

Posts (Atom)