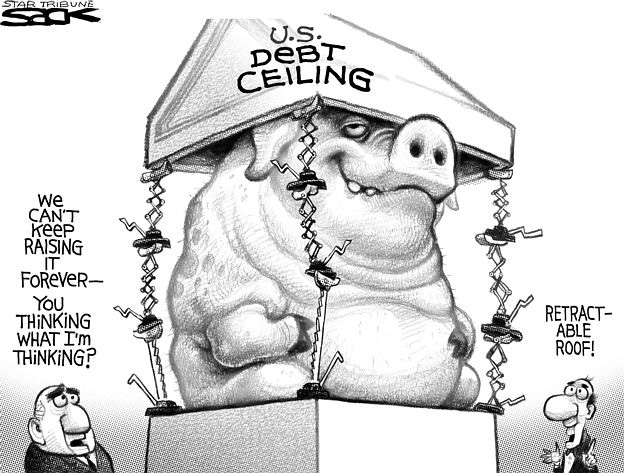

The government's debt ceiling has been the focus of heated debate in Washington, as many economists, politicians, and pundits buy into the notion that the debt ceiling must be raised to avoid economic disaster. The reality is that many potential catastrophes have been threatening the U.S. for years now, as a consequence of our growing debt. Treating our unhealthy fiscal state with more debt may stave off withdrawal symptoms for a while, but the underlying addiction to spending remains, and grows worse by the day.

I only wish that the national (bought and paid for) media would focus on the default issue, rather than the angle of increasing our debt limit. What good is increasing, or even doubling, our debt limit when we are so close to defaulting on paying the minimum payments on the nation's credit card? We are borrowing from our children to make interest payments at this point, so I have little faith that our "representatives" with stop playing games long enough to present a practical solution that includes massive spending cuts, which are what the country needs to control it's debt, as well as drastically reducing taxes to restart the failing economy. Wow. It really appears simple when you take a step back to look at the situation from a realistic perspective.

Despite the fact that a debt ceiling increase only provides temporary, superficial respite, many of those who favor such a move give too much weight to the impact of the debt ceiling. In a recent op-ed in the Washington Post, Virginia Senator Mark Warner argues, "Failing to raise the debt ceiling will increase interest rates, gut consumer confidence, and drag down business investment and job creation." The notion that changing an artificial construct like the debt ceiling will have such a massive impact on real economic conditions comes from viewing the economy in the abstract. Rather, the economy is comprised of people who engage in millions of exchanges every day. Because the economy is not an abstraction but is very real, it is unlikely that an arbitrary debt limit would dramatically affect real economic conditions. Some parts of the doomsday scenario posed by officials like Senator Warner, Treasury Secretary Tim Geithner, and the president may well come to pass: rising interest rates, consumer confidence falling, job creation declining. However, it is not likely to be the sole result of a failure to raise the debt ceiling, as we already see many of these symptoms occurring.

No comments:

Post a Comment