US Debt Crisis: Capitol Hill Ready To Strike Deal - But At What Cost?

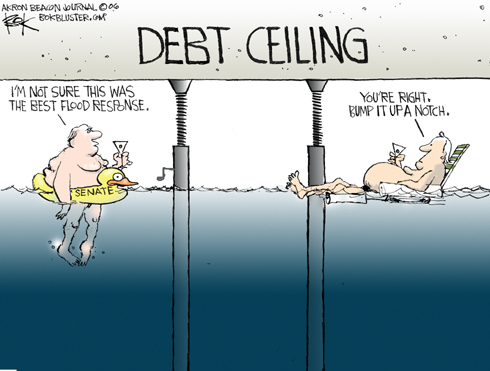

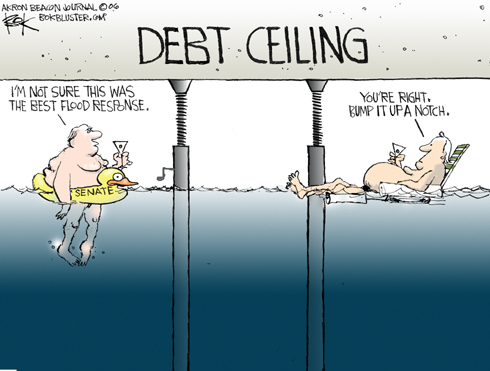

America could soon lose its much-coveted triple-A credit rating, possibly by the end of this week, as politicians in Washington race to clinch a deal to solve the debt crisis in what is likely to be a volatile week for global financial markets.

On Monday morning the dollar rose against the yen and Swiss franc as hopes grew that a deal could be reached to raise the $14.3tn ceiling on borrowing to enable US public workers to be paid, and the country to keep functioning. In early trading the New Zealand dollar was just shy of a 30-year high, while the Australian dollar also edged up.

But while there was some relief that an outright US default on debt payments might now be avoided, there was lingering concern that congressmen might not fall behind the $3tn of cuts needed in return for a $3tn rise in the debt ceiling before Tuesday's deadline – when the White House has warned the money runs out.

Anxiety was apparent on both sides of the Atlantic about the implications of the crisis in the US, where data on Friday showing the US economy has stagnated further heightened tensions in the market.

If a deal is done, market experts predict a rally on Wall Street (which lost almost 4% of its value last week), and for the dollar to rise against the Swiss franc.

But any relief is likely to be short-lived if the ratings agencies move quickly to downgrade the debt rating, although some economists believe that a downgraded rating may not have the same impact as it has on some eurozone countries where the cost of borrowing has reached punitive levels.

As the world's biggest bond market, the US is supported by China, which owns up to one third of foreign-held treasuries, although economists at Capital Economics believe China would keep buying treasury bonds even if they were downgraded.

No comments:

Post a Comment