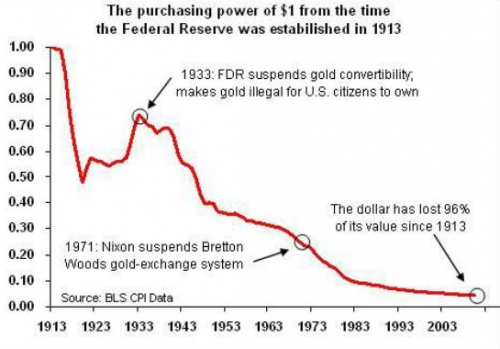

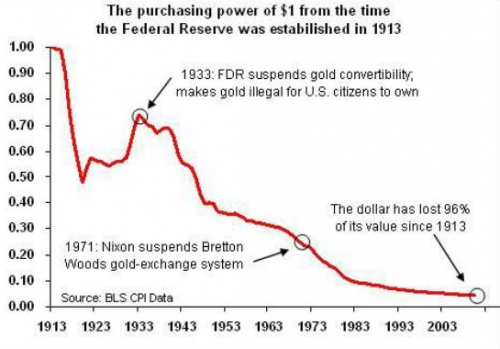

Fourty-one years ago (actually yesterday), president Nixon severed the connection between the US currency and any resource backing, effectively setting the stage for increased rates of inflation into the future. This was one of the most important decisions in modern financial, economic and monetary history and is a seminal moment in the creation of the global sovereign debt crisis confronting the U.S., Europe and the world in 2012. The dollar has since fallen from 1/35th of an ounce of gold to 1/1750th of an ounce of gold.

More at the Daily Bail.

The stability of gold in trade was part of what kept the dollar from fluctuating wildly, though increases and decreases in it's value were common. What has been often overlooked since 1933 is the absense of any sustained increase in the value of the dollar. Nixon's actions were simply a nearly unnoticed blip on the race to the bottom.

This inflation is the invisible tax which Mises describes often;

Inflation: An Unworkable Fiscal Policy

On August 15, 1971, President Nixon announced on TV 3 dramatic changes in economic policy. He imposed a wage-price freeze. He ended the Bretton Woods international monetary system. And he imposed a temporary surcharge (tariff) on all imports. The Bretton Woods system was created towards the end of World War II and involved fixed exchange rates with the U.S. dollar as the key currency - but also a role for gold linked to the dollar at $35/ounce. The system began to falter in the 1960s because of an excess of dollars flowing out of the U.S. which foreign central banks had to absorb. A run on gold in 1968 was stemmed by a patch on Bretton Woods known as the two-tier gold system. All of this was ended unilaterally by the Nixon decision.

Inflation, an increase in money and credit, is certainly not a means to avoid or to postpone for more than a short time the need to resort to taxes levied on people other than those belonging to the rich minority. If, for the sake of argument, we leave aside all the objections which may be raised against any inflationary policy, we must take into account the fact that inflation can never be more than a temporary makeshift. Inflation cannot be continued over a long period of time without defeating its fiscal purpose and ending in a complete debacle as was the case in this country with the Continental currency, in France with the mandats territoriaux and in Germany with the mark in 1923.

No comments:

Post a Comment